Moving debit cards from Visa® to Mastercard®

We are always looking for ways to improve our offerings and add value and benefits for our FinancialEdge Credit Union members. For this reason, we will be converting all of our credit cards from Visa® to Mastercard.® Don’t worry! We are making every effort to make this transition as easy and seamless as possible for you.

IMPORTANT DATES:

WEEK OF AUGUST 20: New Mastercard debit cards will be arriving. You can activate and begin using your new card right away!

SEPTEMBER 3: The last day your Visa debit card can be used.

KEY INFORMATION:

Your new Mastercard debit card comes with the following features:

- EMV Chip Technology: Your new debit card will have an embedded microprocessor chip that stores and protects your data. It will help increase security and reduce fraud. The EMV chip will be in addition to the standard magnetic strip.

- 24/7 Cardholder Service: Call 989-892-6088 for balance inquiries, transaction history, statement requests or to dispute a transaction.

- Online Access: Real-time debit card information, including transactions, pending activity, and custom email alerts. Plus, sign up for electronic statements when you log into your account online at electronicedge.org.

What to know:

- Your new Mastercard should be arriving the week of August 20, 2018.

- New cards will be mailed to all cardholders. Your debit card number and your expiration date will change.

- If you plan to use your card at any ATM, you will be required to use a PIN. You will receive your new PIN number in the mail.

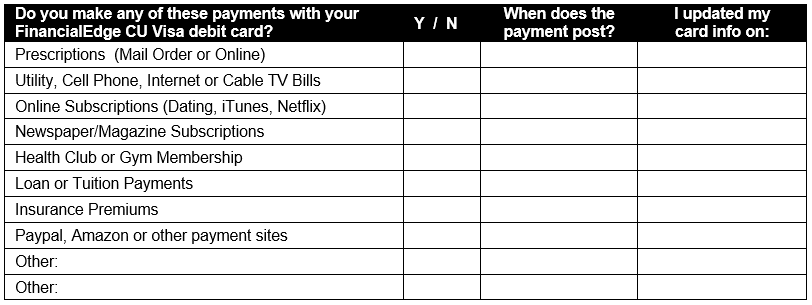

- If you have automatic payments set-up with your current debit card, make sure to contact each vendor with your new updated debit card number to help avoid late payments or service interruptions.

- See our FAQs below. If you have any additional questions or inquiries before the conversion date of September 3, 2018, please call us at 989-892-6088

- CardNav adds another level of security to your cards by letting you decide how and when they can be used, and alerting you when any types of transactions you specify take place. You can even use CardNav to set personal spending limits that help you stay within your budget goals.

- Turn cards on or off in seconds

- Use GPS to restrict transactions to businesses within a designated area.

- Limit card use to specific merchants or purchases.

- Receive real-time, in-app alerts that let you stop unauthorized purchases before they’re complete.

- Receive alerts when you’re getting close to any personal spending limits you’ve set.

- Mobile Wallet Options that will work with your new debit card:

- You will also now be able to change your PIN number right at any of our ATMs.

Why am I receiving a new debit card?

FinancialEdge Credit Union is changing the debit card processor to better serve your needs. This change requires that a new card be issued.

Will I have a new PIN number?

Yes, your old PIN will not work with the new card and you will be receiving your new PIN number in the mail.

My existing card does not expire for quite a while; can I continue using my existing card until expiration?

No. Your existing card will not work after September 3, 2018. Instructions will come with your new card to ensure it is ready to use on or after this date.

My spouse and I both have FinancialEdge debit cards, and I only received one card. Will my spouse receive a card?

Yes. As a security feature, all cards being issued with this conversion will have a unique number and will arrive separately.

What do I need to do if I have preauthorized or recurring payments that are tied to my existing FinancialEdge debit card?

To ensure there is no interruption in recurring or preauthorized payments (such as monthly telephone, electricity, gas bills, insurance, clubs, online services, etc), contact the merchant the day you receive / activate your new card.

Will my previous debit card history transfer still be available after the conversion?

Absolutely! All of your transaction history will still be available as usual within home banking, via our mobile app or by calling us at 989-892-6088.

Go to main navigation